eCommerce distribution centers are revolutionizing how online businesses meet the growing demand for rapid delivery. As consumer expectations for faster delivery continue to rise, driven by industry giants like Amazon and Walmart, even fast-growing businesses must adapt to remain competitive.

The challenge for growing brands is clear — deliver products quickly without sacrificing profit margins. This is where eCommerce distribution centers play a pivotal role, offering a strategic solution that effectively balances speed and cost to ensure rapid delivery and healthy profits.

This article explores what an eCommerce distribution center is, its benefits, and how it can transform your fulfillment strategy so you can meet modern shipping process expectations efficiently.

What is an eCommerce Distribution Center?

An eCommerce distribution center is a specialized facility designed to store, process, and distribute products for online retailers. These centers serve as important hubs in the eCommerce supply chain, managing large volumes of inventory and coordinating the movement of goods to various destinations, primarily fulfillment centers or large box stores.

How Does an eCommerce Distribution Center Differ from an eCommerce Fulfillment Center and a Warehouse?

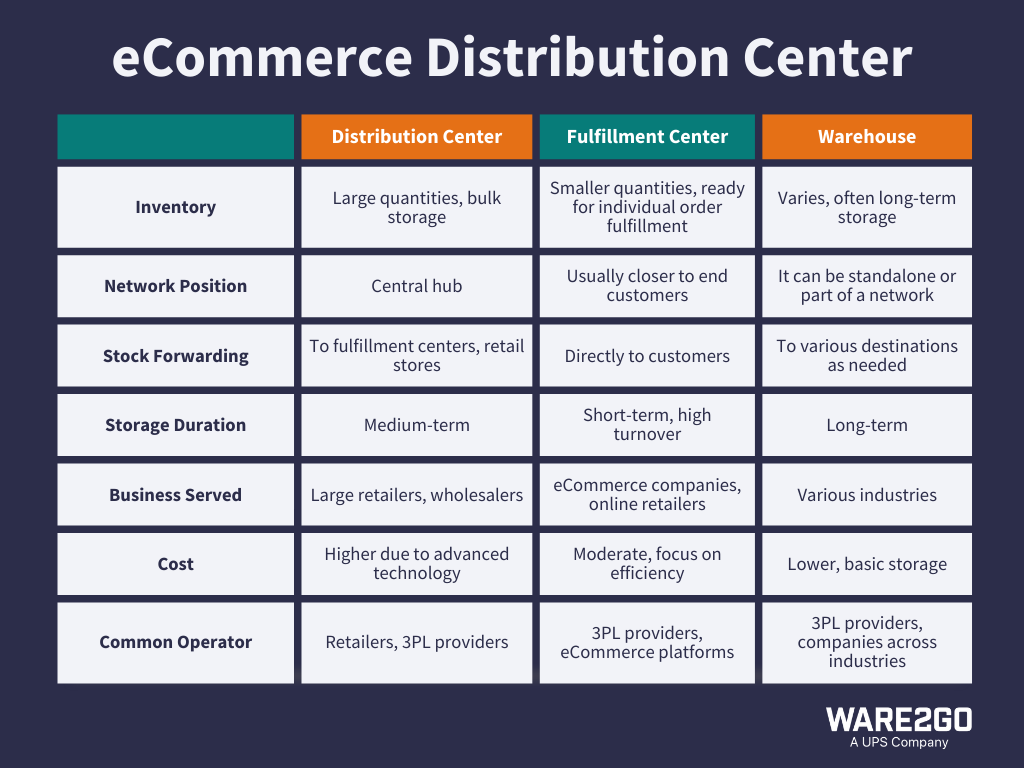

The terms distribution center, fulfillment center, and warehouse are often used interchangeably, but there are subtle differences between them.

A warehouse is filled up by manufacturers and suppliers. Goods in a warehouse are stored for a long time, sometimes up to years. The warehouse essentially serves as a store for inventory.

The distribution center, on the other hand, is set up to optimize distribution. It stores goods that are expected to leave the shelf fast so they can reach consumers quickly.

A fulfillment center gets goods from distribution centers and ships orders directly to customers. Some fulfillment centers provide receiving, storage, picking, and packaging services based on suppliers’ specifications.

Some business models could have all three in their supply chain network, but most don’t. For example, eCommerce sellers that ship directly to customers prefer fulfillment centers, not distribution centers. On the other hand, distribution centers are better for larger businesses shipping goods in bulk, especially those with a large brick-and-mortar store network.

How Does an eCommerce Distribution Center Fit into a Fulfillment Network?

As a waystation, eCommerce distribution centers give sellers more control over how inventory is stored and redistributed coast-to-coast. These facilities receive bulk shipments from manufacturers or warehouses via trucks or cargo containers.

Upon arrival, inventory is processed, sorted, and organized into bulky/semi-bulky regional orders using advanced inventory management systems. These orders are then sent to fulfillment centers or large box stores close to the distribution center.

Since these fulfillment centers/large box stores don’t have to ship directly from the warehouse, the distribution center is part of the larger logistics network designed to reduce transportation costs and accelerate transit times.

Depending on demand forecasts, distribution centers typically store items for medium-term periods, from weeks to months. Reducing the final shipping distance helps avoid costly shipping fees while meeting fast delivery expectations, supporting strategies like Amazon’s 1–2-day delivery commitments.

What Are the Benefits of an eCommerce Distribution Center?

An optimized eCommerce distribution center in your fulfillment network offers the following benefits.

1. Stores Large Quantities of Inventory

Seventy-nine percent of shoppers are more likely to make a future purchase after a positive delivery experience, and the more goods you can stock close to end consumers, the better.

This allows you to maintain adequate stock levels to meet demand fluctuations, ensuring product availability and reducing stockout risk.

2. Long-Term Storage at Low Cost

Distribution centers offer more cost-effective long-term storage solutions than fulfillment centers. This is beneficial for slow-moving items or seasonal products. It prevents costly stockouts and burning cash flow on inventory on warehouse shelves for long periods.

3. Delivers High Volumes of Items from Business to Business

For businesses that supply large box stores or fulfillment centers, the distribution center excels at handling bulk shipments between businesses, facilitating efficient B2B transactions, and replenishing inventory for retailers and wholesalers.

4. Less Expensive than Storing Inventory at Fulfillment Centers

Fulfillment centers deal with individual orders, so it gets costly if your orders are large. By centralizing inventory storage, distribution centers reduce the overall inventory management cost compared to storing products at multiple fulfillment centers.

5. Expert Fulfillment Staff Benefits

Supply chain experts handle the operations at distribution centers.

As a result, your inventory is managed, prepared, and shipped much more efficiently and with better customer service through precise order fulfillment.

6. Reduced Overhead Costs

Outsourcing your order distribution and fulfillment reduces overall business logistics and operational costs.

7. More Time to Focus on More Productive Business Tasks

Outsourcing your order distribution frees time to focus on more valuable business tasks. By outsourcing distribution operations, businesses can allocate more resources to core activities such as product development, marketing, and customer relationship management.

8. Helps Meet Customers’ Fast Delivery Expectations

In the age of the “Amazon Prime effect,” distribution centers play an essential role in meeting consumers’ expectations for fast, inexpensive shipping. They achieve this through:

- Forward stocking inventory close to customers nationwide, reducing shipping distances and costs.

- Following organizational best practices for efficient inventory management, preparation, and shipping volume.

- Successful inventory management, minimizing lost items, and improving tracking accuracy to reduce delays and shipping errors.

- Maintaining optimal inventory levels to prevent stockouts while avoiding excess inventory that ties up cash flow.

What Makes an eCommerce Distribution Center Great?

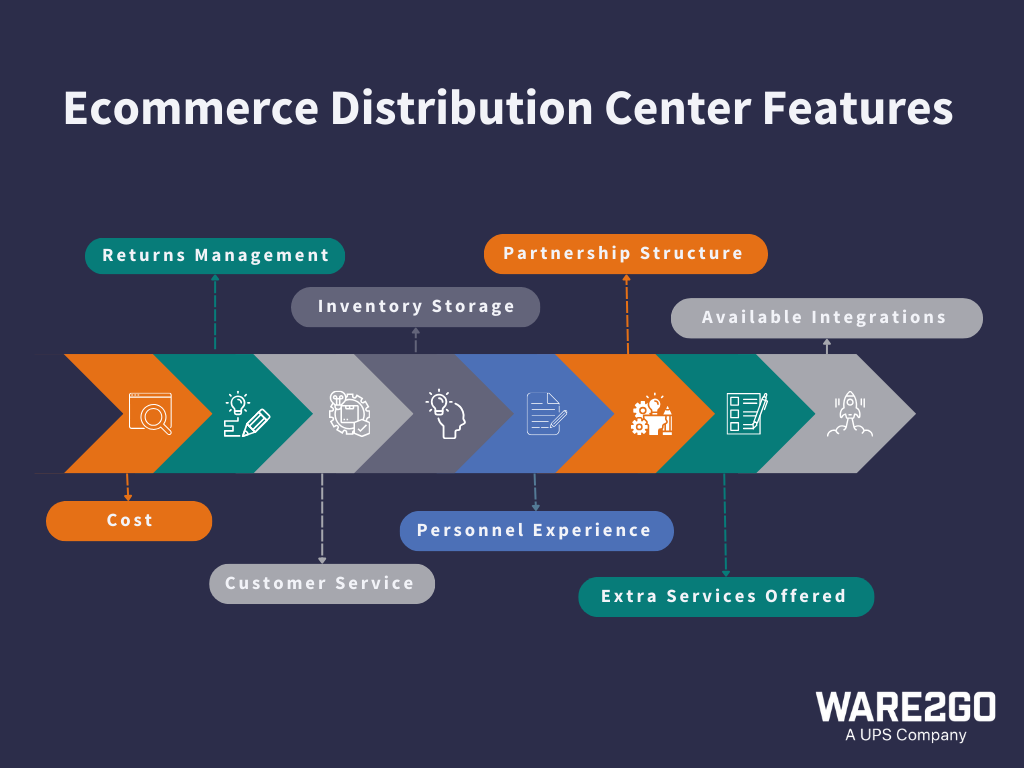

Consider the following features when deciding which eCommerce distribution center to partner with.

1. Personnel Experience

Skilled warehouse staff are crucial for efficient operations. Effective distribution centers invest in comprehensive training programs and industry certifications. Ware2Go, for instance, ensures top-tier personnel through rigorous training and continuous skill development.

Advanced Warehouse Management Systems (WMS) are essential for streamlined operations. The best centers use systems that integrate seamlessly with popular eCommerce platforms, enhancing visibility and control across the supply chain.

2. Software Used and Available Integrations

Most distribution centers use WMS to track inventory and demand and decide how and when to stock. The best centers use systems that integrate seamlessly with popular eCommerce platforms, enhancing visibility and control across the supply chain.

3. Inventory Storage Issued per Partner

The inventory space you need changes with seasons and alterations in consumer’s tastes.

Partnering with a distribution center with flexible inventory capabilities helps you adapt to your customers’ demands.

4. Returns Management

Managing returns without handling shipping can leave your staff frantic. Efficient return shipping, restocking, and quality control procedures minimize losses and maintain inventory accuracy.

Partner with an end-to-end supply chain partner that takes everything off your plate.

5. Support and Customer Service

A distribution center that resolves customer complaints and clarifies confusion quickly improves customer service and achieves higher fulfillment quality.

6. Cost

Consider pricing models (like per-unit, storage-based), and choose the one that fits your business’s needs.

A partner with a fixed pricing model that can’t change as your business needs change might not be right.

7. Partnership Structure and extra services

Value-added services such as kitting and custom packaging set a distribution center apart. Some centers offer additional benefits, like:

- Seller Fulfilled Prime (SFP) support.

- Priority pickups during peak seasons.

- Specialized handling of product launches and flash sales.

Ware2Go, for example, excels in these areas, offering tailored solutions that adapt to business needs. Our support for the services demonstrates our commitment to providing comprehensive service.

Streamline Your eCommerce Distribution Center Strategy with Ware2Go

Online sellers can meet consumer expectations without overspending by partnering with an order fulfillment fourth-party logistics (4PL) provider for outsourced order fulfillment. This approach reduces logistics costs, warehouse space, and operational inefficiencies from managing multiple fulfillment solutions.

A single network for all sales and distribution channels improves data visibility and boosts sales in high-performing channels.

Ware2Go, a 4PL created by UPS, is dedicated to helping rapidly growing businesses across many industries. With us, you can achieve a nationwide 2-day delivery through a single provider, ensuring the efficiency and reliability of your order fulfillment process.

To learn more about how Ware2Go creates smarter fulfillment networks, contact one of our fulfillment experts.